Using Fresh Theater Experiences to Attract & Retain New Customers for Grocery Retail Growth

IN-STORE FRESH JUICING

We are in business to satisfy customer needs. The grocery retail industry is going through a period of rapid change. Many of these changes are being driven by demographic shifts, developments in technology, and competition with new, innovative players entering the segment. Some grocery stores choose to compete on price, while others offer premium products and innovative business models.

But let’s keep it simple and focus on the fact that grocery stores are in business to satisfy the consumers’ needs:

- Consumers want fresh and healthy products.

- Consumers want exciting experiences.

- Consumers want amazing taste.

- Consumers want fast simple convenience.

- Consumers want transparency: to know where their products come from.

- Consumers want value for their money.

In addition to the above points, the most recent pandemic experience has accelerated some trends and heightened consumer awareness around health, safety, and hygiene. The consumer demand for convenience along with the increased demand for safety, for example, has driven more on-line retail solutions. This poses new challenges for the traditional grocery retailer.

LET'S KEEP IT SIMPLE

PwC, in their article, Experience is Everything: Here’s How to Get it Right, PwC explains: Give customers a great experience and they’ll buy more, be more loyal and share their experience with friends. The challenge, of course, is getting it right. If you get it right, you can charge a premium. When you get it wrong, you risk losing your customers.

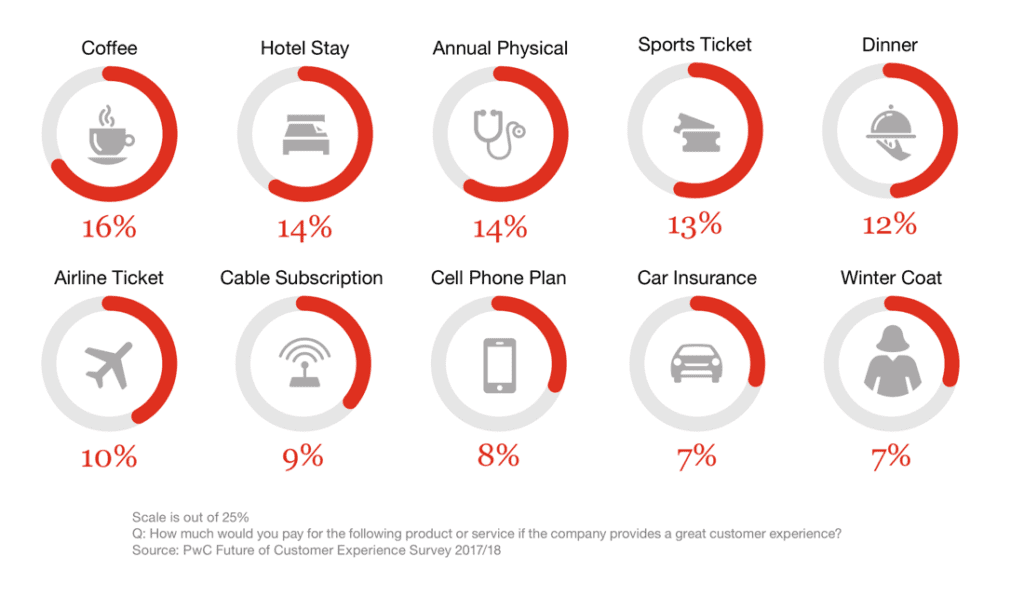

In the below graphic, “The price premium of good customer experience”, we can see that ‘getting it right’ in the coffee segment can allow premium pricing on the average of 16%. Hotels that deliver great experiences can command a premium and get more business. I’m sure we can all think of our favorite café, hotel, or restaurant, and recognize our willingness to pay a premium because we value the product and the experience.

The price premium of good experience | Source: PwC Consumer Research (future-of-cx)

While grocery store shoppers can be highly price-sensitive, we see growth in premium products and growth in new innovative in-store offerings and products. Certain grocery store chains have been able to grow faster than others, while other grocery retailers have continued to shrink, or even go out of business.

The Progressive Grocer highlights continued growth in ‘food service’ in the grocery channel as an attractive growth opportunity with strong development in the deli, salad bar, hot meals, sushi, and a range of prepared foods. According to the National Restaurant Association: 63% Consumers who say they would rather spend money on an experience such as a restaurant or other activity, compared to purchasing an item from a store. The lines separating grocery stores, convenience stores, and restaurants have clearly started to blur, but there are common themes.

The grocery stores that offer outstanding consumer experiences, with in-store food service and innovative products have gained significant market share and have been able to capture premium pricing. The retailers who have failed to offer such experiences and have failed to offer value to their shoppers have suffered.

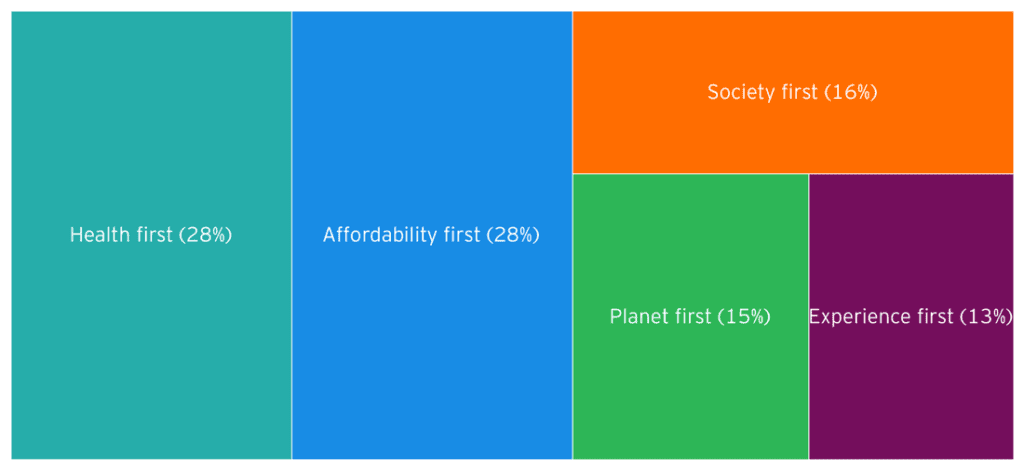

In their own separate research, E&Y has clearly defined five (5) segments that have their own priorities. Health first is the largest identified segment. “The largest segment of the future US consumer will make choices that protect their health and that of their family before anything else. They will choose brands and products they trust to be safe, and thus transparent.” This is not just about ‘healthy’ – it’s about trust and transparency.

It’s worth noting that ‘Experience first’ is a smaller segment, but it is a segment in its own right. This is a segment that is clearly focused on ‘Experience first’. “These are the consumers likely heading back to the store first. As they look for products and services they feel are made just for them, personalization for this segment will be key.”

Source: E&Y Future Consumer Index

In “The future of fresh”, Deloitte differentiates between ‘Conventional’ and ‘Contemporary’ consumers. “The contemporary consumers’ outsized commitment to the fresh food category is evident in both tangible and intangible ways. Starting with the tangible, they are more willing to pay a premium for fresh food (75% versus 62% for conventional consumers).”

ACCELERATING TRENDS ACROSS THE INDUSTRY

We’ve highlighted some areas of opportunity above. We’re all very aware that consumer behavior changed during COVID. Some key trends were greatly accelerated and some of these trends will continue.

- The dramatic increase in online grocery shopping

- Increased use of foodservice delivery

- Increased use of telemedicine

- The sharp increase in online education

- Accelerated trends with online entertainment

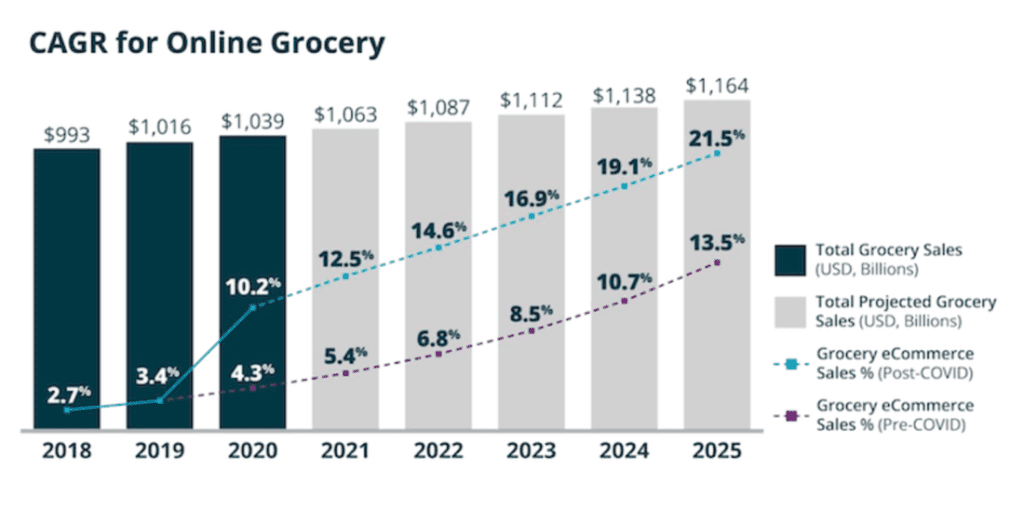

These accelerating trends clearly support both ‘convenience’ as well as ‘safety’. According to Supermarket News, online market share more than doubled with the onset of COVID. There was a major shift in market share and the growth in online grocery is expected to continue.

With the loss of market share to the online channel, the physical brick & mortar retailer will continue to lose in-store foot traffic. Retailers, in general, have to look for ways to drive their business forward and compete in ways that online retailers can’t keep up with… or offer hybrid solutions that leverage their physical and online capabilities.

Source: Supermarket News September 18, 2020, Russell Redman

THE CHALLENGE FOR RETAILERS

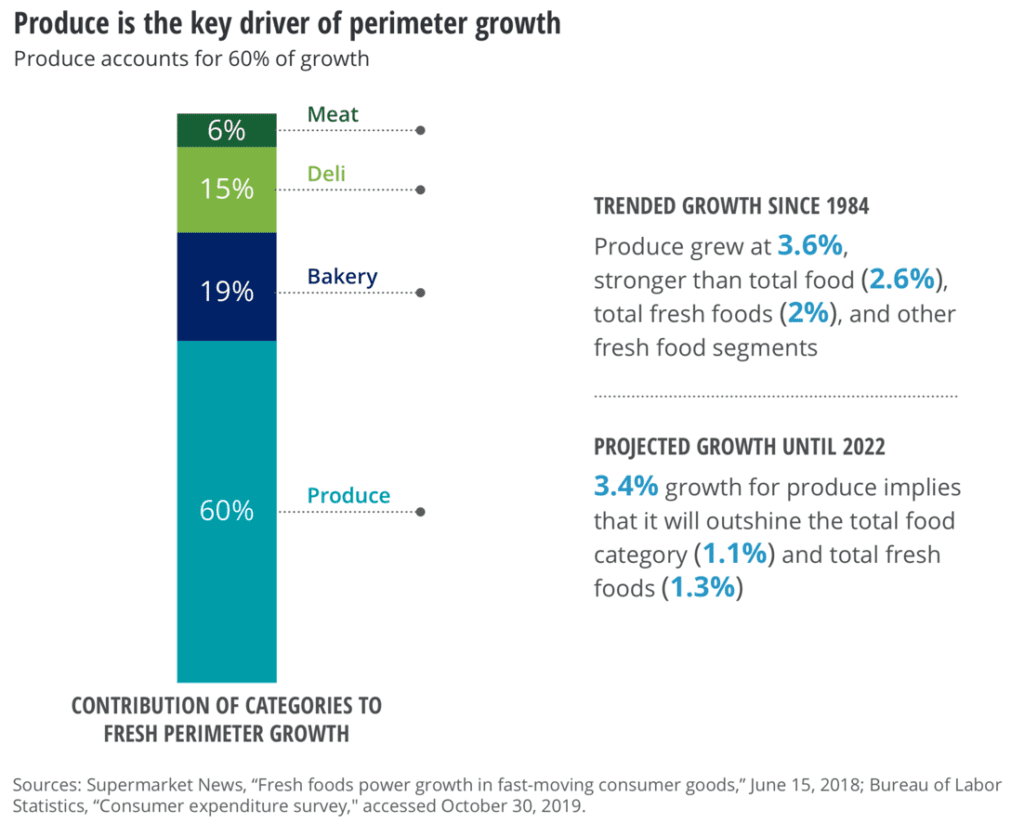

Source: Deloitte – Future of Fresh: Perimeter Growth

THINKING ABOUT SOLUTIONS

THE IN-STORE FRESH CITRUS JUICING EXPERIENCE

Citrocasa 8000SB-ATS Citrus Juicer with Peripherals

EFFICIENCY & SAFETY USING AN AUTOMATIC JUICER

FRESH CITRUS JUICING PROGRAMS THAT DRIVE EXCITEMENT & PROFITS